Brian MilneCrunch Network Contributor

Brian Milne is a freelance writer and former senior reporter/editor for McClatchy Newspapers, advocating sustainable water technologies and precision agriculture.

The federal government is often criticized by Silicon Valley for being outdated and slow to react to cutting-edge technologies.

That old-hat perception is compounded in the agriculture industry, where many agreements take place with dirt-crusted handshakes on backcountry roads, rather than HD video conference calls between Bay Area skyscrapers.

But the U.S. Department of Agriculture is striving to shed old-school labels, making swift strides in the past year to accelerate some of the innovative technologies combating the country’s water and ag-related resource issues.

One such program is the $154.5 million Advantage Capital Agribusiness Partners, LP, fund, which was licensed as a Rural Business Investment Company (RBIC) by the USDA in April 2014. The RBIC was originally formed in 2002 to promote job creation and economic development in rural America, but funding for the program was cut three years later.

The USDA has since helped resurrect the program as a way to facilitate private equity investments in agriculture-related businesses, with the goal of boosting jobs and ag tech adoption in rural areas.

While the USDA had previously provided loans, grant financing and technical assistance to develop ventures in rural areas, it hadn’t focused on spurring on equity financing (critical to growing businesses in the tech sector) in addition to those borrowed funds.

New public-private partnerships allow the USDA to do just that, facilitating equity support for private investments in businesses working in bio-manufacturing, advanced energy production, local and regional food systems, improved farming technologies and other cutting-edge fields.

At the same time, it allows the USDA to take a step back and let companies such as Advantage Capital Partners to manage the fund in partnership with the Farm Credit System — a network of banks and lending institutions federally chartered to serve agriculture and the U.S. rural economy.

In April, the USDA announced two additional private investment funds, Innova Memphis ($100 million) and Meritus Kirchner Capital ($25 million), would begin raising capital, as well.

“It’s no secret that businesses in rural America face a shortage of investment capital,” said Timothy Hassler, Principal at Advantage Capital Partners. “Advantage Capital Agribusiness Partners is focused on making impactful investments to foster growth and job creation in those rural communities, and we are hopeful that our partnership with USDA and the Farm Credit System will help provide more rural entrepreneurs with access to capital.”

We’ll need as much innovation and creative thought in agriculture over the next 35 to 40 years as we’ve had in the previous 10,000 years.

— U.S. Secretary of Agriculture Tom Vilsack

One of Advantage Capital Agribusiness Partners’ recent investments was a $5 million boost in June to Hortau Corp., a manufacturer of smart irrigation management systems that does much of its work in drought-plagued California.

Hortau’s in-field sensors have helped Golden State growers cut back water use significantly during a time when many farmers have seen surface water allocations cut back by an average of 33 percent.

“These types of investments not only help ag tech companies grow, but create the high-value jobs we need in rural communities,” said Hortau CEO Jocelyn Boudreau. “With the water and other resource issues we’re seeing throughout the country, we need technology more than ever. Investments in data-driven technology will help improve the decisions being made in the field, and that in return will improve production, make operations more sustainable, and can help revitalize rural communities.”

Other investments by Advantage Capital Agribusiness Partners include American Botanicals in April, Iowa Cage-free in February and PacificAg in August.

And all of those investments have taken place since the fund closed in late 2014, a quick turnaround, even by Silicon Valley standards.

“The reality is, there’s more demand than we can meet,” U.S. Secretary of Agriculture Tom Vilsack said of the current needs of rural residents and businesses at the recent Rural Opportunity Investment conference in Washington, D.C. “That’s why we’ve challenged the private sector to partner with us, and we’ve been very pleased with some of the partnerships we’ve created.”

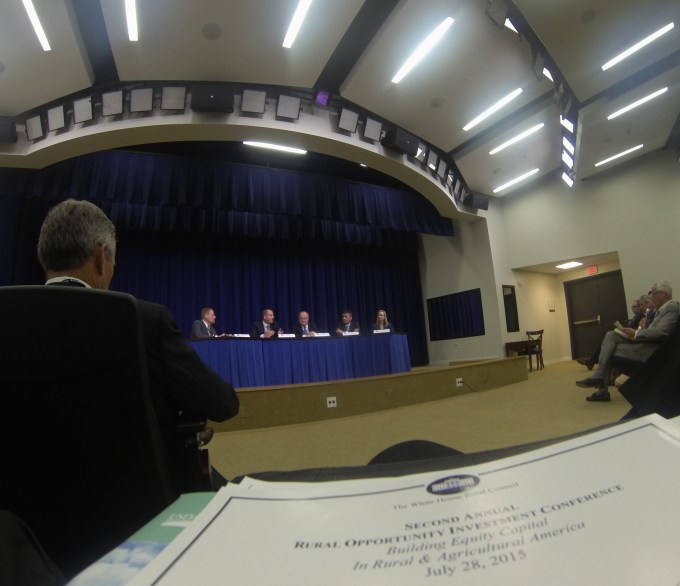

At the recent Rural Opportunity Investment Conference on July 28, the USDA announced its first round of investments in rural infrastructure projects through the U.S. Rural Infrastructure Opportunity Fund. Through the fund and public-private partnerships, the USDA facilitated $161 million in private capital investments in 22 water and community facilities in 14 states.

What does that mean for the tech industry? Well, the investments help bring improved broadband access to 1.5 million rural residents, which will help give ag techs better connectivity in rural communities.

Additionally, more than 158,500 miles of electric line have been improved, serving some 8.6 million residents and businesses in rural areas — a critical move for agriculture and renewable energy companies with hardware in the field and cloud-based software that needs to be accessed by rural users.

During a recent AgTech conference in the Bay Area, Vilsack stressed his dedication to ag technology, accelerating adoption and helping growers continue to grow more with fewer resources (water, land, energy) in its attempt to feed more than 9.6 billion people by 2050.

“We at the USDA want to partner with you as you look at opportunities in rural America,” Vilsack told a room full of investors at AgTech Week, San Francisco. “This is one place where we can collaborate, and send an incredible message about the amazing America that we all know — the entrepreneurial America, creative new products, the industry. You guys could invest in it, you should invest in it, because it’s a heck of a place.”

To help attract additional investments in rural America, the White House Rural Council — part of the “Made in Rural America” initiative — hosted the Rural Opportunity Investment Conference in July. The event promoted opportunities to invest in rural communities by highlighting successful projects in energy, biofuels, bioproducts, infrastructure, transportation, water systems, telecommunications, healthcare, manufacturing and local and regional food systems.

And yes, the event included a number of Silicon Valley investors and business leaders, connecting them with government officials, economic development experts and other partners to help these new technologies grow and succeed in the face to today’s agricultural and global needs.

“Global ag production has to increase globally by 70 percent in the next 35 to 40 years in order to feed a population we expect will reach 9 billion people.” Vilsack said. “What that means is we have to increase productivity of agriculture by embracing innovation. We’ll need as much innovation and creative thought in agriculture over the next 35 to 40 years as we’ve had in the previous 10,000 years to meet that 70 percent increase. There’s tremendous opportunity there.”

Silicon Valley couldn’t agree more.