Summary

The ad-tech marketplace is primed for massive growth in the next few years.

This has attracted players of all sizes targeting different business segments.

The small players are facing a serious challenge in trying to gain market share from thriving giants.

A few of the uniquely modeled small players offer an interesting opportunity for investors, but only if they can weather the storm.

Investors have a major decision to make depending on risk appetite and the potential returns provided by the type of company they choose in the long run.

A few years ago, Google (NASDAQ:GOOG) (NASDAQ:GOOGL) had no match in the online adverting marketplace. I still believe that this search giant continues to dominate this space, but over the last few years other technology companies have launched their bid to get a share of the cake.

We also have noticed start-up companies come in the frame with unique ways of running online ads from email marketing campaigns to affiliate marketing and many more. Right now there are more than 200 companies in the ad-tech industry, including both private and publicly listed players, but only a few are well renowned.

For a large part of the last couple of years, the battle has been on image/text (display)-based ads, but online video advertising also has been growing significantly with the likes of Facebook (NASDAQ:FB) playing a major role along with industry veteran Google.

In general, the ad-tech industry features different types of players in various sizes and market segments. For instance, Rocket Fuel (NASDAQ:FUEL) is a programmatic marketing platform that utilizes big data in championing marketing campaigns with a view of increasing audience interaction and conversion rates.

As such, the company’s revenue streams significantly rely on the quality of traffic provided for its clients, though not necessarily by the number of conversions/clicks. Rocket Fuel went public in 2013 via an IPO, but since the beginning of 2014, the company’s stock price has declined massively. Illustratively, FUEL stock price is down nearly 90% over the last two years.

This decline has largely been attributed to the growing issue of fraudulent traffic in the online advertising marketplace, which now threatens some of the fully fledged players as customers weigh their budgets against results.

This is the same case with many of the end-to-end players in the ad-tech industry, with the most impressive being Criteo SA (NASDAQ:CRTO), which is up by about 10% over the last two years.

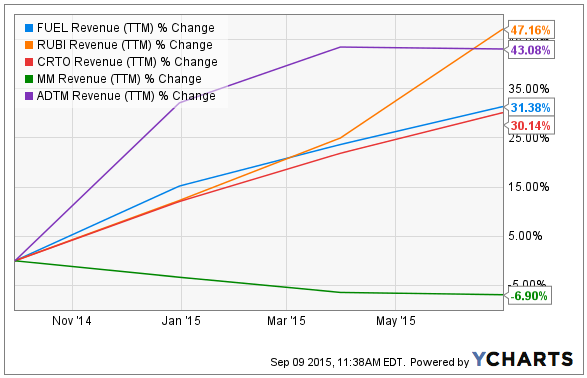

Interestingly, these companies have been pretty decent in terms of revenue growth, with The Rubicon Project (NYSE:RUBI) revenues up 47%. RUBI’s business model is slightly different from that of Rocket Fuel. The company offers a more sustainable revenue stream model via its cloud advertising platform which provides both buyers and sellers with an opportunity to automate their end of business. As such, the company’s revenues are transaction-based rather than traffic-based.

Shares of the Rubicon Project are currently down about 24% over the last two years, but have achieved a significant gain in the last 12 months, rallying 44%. On a trailing 12-month period basis, Rubicon remains unprofitable, but the company’s quarterly revenue growth of 87% year-over-year offers a lot of promise going forward.

RUBI is not the only company in the ad-tech marketplace reporting positive revenue growth. Criteo, which is one of the best stocks in the industry, has experienced a revenue change of 30% for a trailing 12-month period. Again, Criteo’s revenue model promises sustainable growth due to the fact that customers are likely to have more faith in its marketing structure than FUEL.

The Paris-based Internet information provider leverages granular data to engage and convert customers on behalf of its advertiser clients. Customers are charged on a cost-per-click basis which can be easily related to conversion rates. As such, the company’s revenue is tied to conversion rather than just traffic, which means that in the long run, customers are bound to become more loyal.

Notably, not all companies in the ad-tech market place have managed to grow revenues in the last two years. A good example in this case is Millennial Media (NYSE:MM), whose revenues are down nearly 7% for the trailing 12-month period.

Now, Millennial Media’s business model is similar to that of Rocket Fuel and thus has been on the receiving end of customer skepticism following reports of fraudulent/useless traffic. However, Millennial only focuses on mobile advertising, which is presently a huge challenge for many companies.

This means that Millennial could still improve in the near-term future as more companies continue to add mobile advertising in their marketing budgets. The company’s stock price is down about 74% over the last two years, which makes it an interesting prospect for the long-term future.

Millennial also is among the smallest players in the market with a market valuation of about $245 million, but still not the smallest. There are up and coming nano-cap players too, which actually seem to be doing better than MM in the topline. For instance, Adaptive Medias (OTCQB:ADTM) has experienced one of the best revenue increments at about 43% change TTM.

Adaptive Medias operates as a programmatic audience and content monetization provider for website owners (publishers) and video content producers looking to optimize content through ads. At the beginning of this month, ADTM signed International Media Agency Group to its Media Graph Ad-Tech Platform, a deal that promises to yield massive returns to the company.

International Media Group receives more than 45 million impressions on a daily basis and Adaptive Medias is looking to book some of the revenues associated with the deal in Q3. However, it’s Q4 that the company expects to nail the big fish, which could see its annual revenues soar to record highs.

Can these companies compete with the giants?

It’s worth noting that some of these companies are in direct competition with industry giants, such as Facebook, Google, Yahoo (NASDAQ:YHOO) and AOL, but in general they all face competition from them either directly or indirectly. After all, they are all after the same customers.

However, there are a few that are slightly unique and that may be good enough to trigger the interest of investors. The ad-tech industry is growing by the day, and even mobile adverting is now catching up with desktop ads. Mobile ad spend is expected to top $100 billion by the end of next year, representing a 430% increase from 2013. In fact, analysts predict that next year, mobile advertising will outstrip desktop advertising as companies continue to make the shift to mobile.

This fact gives small players like Millennial Media a fighting chance, but they will have to get over those reports linking them with fraudulent traffic.

In addition to this, these companies would have to rival incumbent giants like Google’s AdExchange, which is still the go-to platform for many advertisers.

On the other hand, Criteo’s unique monetization model of cost-per-click may be enough to woo customers and most importantly to keep them using its platform. As such, Criteo still stands as one of the promising prospects from an investment perspective alongside Rubicon Project, which as noted earlier is quite different in the sense that its revenue is transaction-based.

Rocket Fuel has been one of the biggest victims in the battle with the giants but it still continues to show decent numbers in the topline after growing revenue by 31% TTM. However, the company’s programmatic marketing looks to be in constant collision with Google’s AdExchange, Aol and Yahoo, and this sets it up for a tough campaign going forward.

Nonetheless, global spending on big data is currently growing at 30% CAGR and is expected to top $114 billion within the next three years. Therefore, given Rocket Fuel’s utilization of Big Data tools in its marketing platform, the market is there for the taking. The only problem is that the company would have to wrestle huge players in order to get a grip on it.

A lot of growth also is expected in mobile video ads, with reports suggesting that video views will account for about 66% of mobile traffic by 2018. As such, publishers will be on the lookout for the best ways to monetize their content on mobile and this creates an opportunity for small players like Adaptive Medias, which seems to be already attracting interest from large international media companies.

So what type of company should you be looking to invest in in order to bet on the explosively growing ad-tech media space?

At the moment, the cautious investor would be going for the giant players in this space as they offer low-risk investment opportunities. However, if you are a growth-oriented investor, identifying one of the uniquely modeled companies would be ideal for a long-term value play.

Uniqueness is crucial because a company needs the ability build its own client base at relatively low pricing pressure as compared to when launching a direct attack at the already established players. In this case, Criteo, Rubicon and Adaptive Medias seem to provide good potential, but again some of these stocks are very risky and are traded at very low liquidity levels.

As for Millennial and Rocket Fuel, there is still some light at the end of the tunnel, especially given the massive plunge in their stock prices. However, with many of these still unprofitable, investors would be wondering how long it’s likely to take before profits start coming in. This could be a major decision threshold given the massive competition in the industry. Notice that there are over 200 players in the ad-tech space, and only the unique ones along with the giants are likely to survive while the rest could be ideal for acquisition.

Conclusion

The bottom line is that there is value tied to growth in the ad-tech space as demonstrated using those impressive ad spend projections for both mobile and big data. Companies that already hold a massive chunk of the market like Google are likely to benefit the most. However, the resultant return to investors may not be that much due to the company’s size.

Additionally, much of this growth is potentially already priced into the shares of Facebook, Google, AOL, Yahoo and the other big guns, but for the small players that carry a huge investment risk, the payout could be massive if they can weather the storm.

Editor’s Note: This article covers one or more stocks trading at less than $1 per share and/or with less than a $100 million market cap. Please be aware of the risks associated with these stocks.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…)I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.